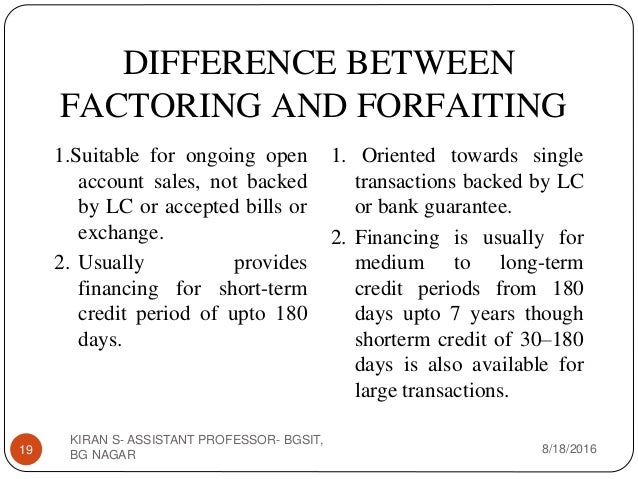

However in a bank guarantee the beneficiary is paid on non fulfillment of obligation as per contract of BG. Used more commonly by merchants involved in imports and exports of goods on a.

Index Php Standby Letter Of Credit Vs Bank Guarantee Differences Sblc Vs Bg

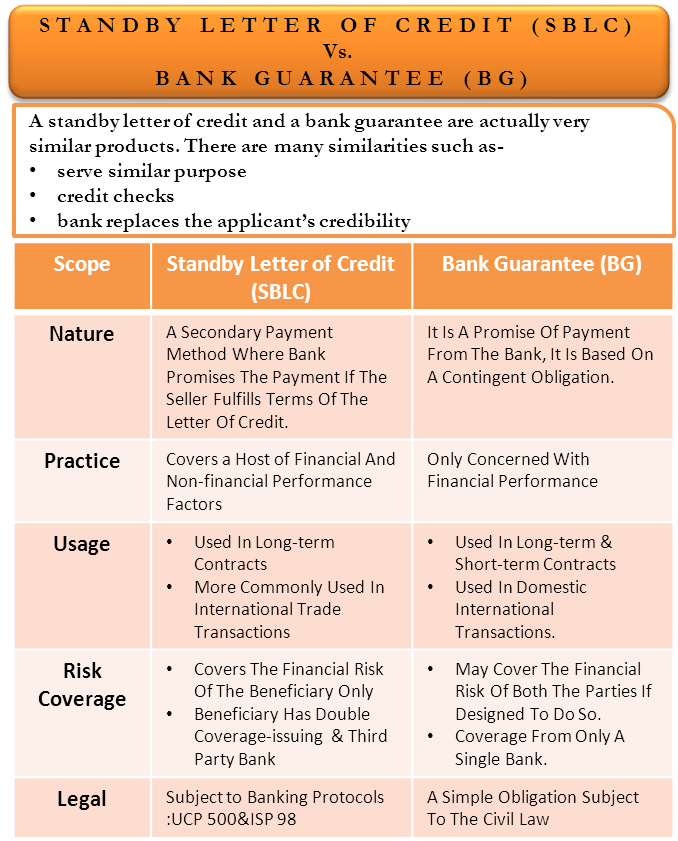

Difference between a BG and a SBLC is legal a BG is a simple obligation subject to civil law whereas a SBLC is issued subject to UCP 500 and ISP 98 both well-accepted banking protocols.

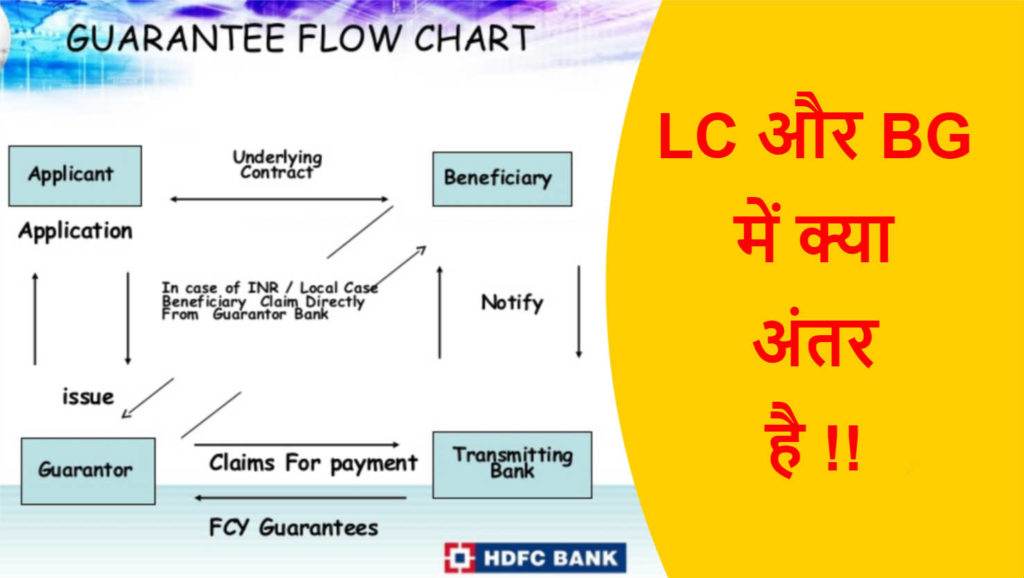

Difference between bg and lc. The major differences between SBLC and BG are. On the other hand in a bank guarantee the bank assumes liability when the client fails make payment. Bank Guarantees and LCs are financial instruments often used in inland or international trade when suppliers or vendors do not have established business relationships with their counterparts.

A standby letter of credit SBLC vs Bank guarantee BG. Answer 1 of 2. This two terminology looks similar but both are very different.

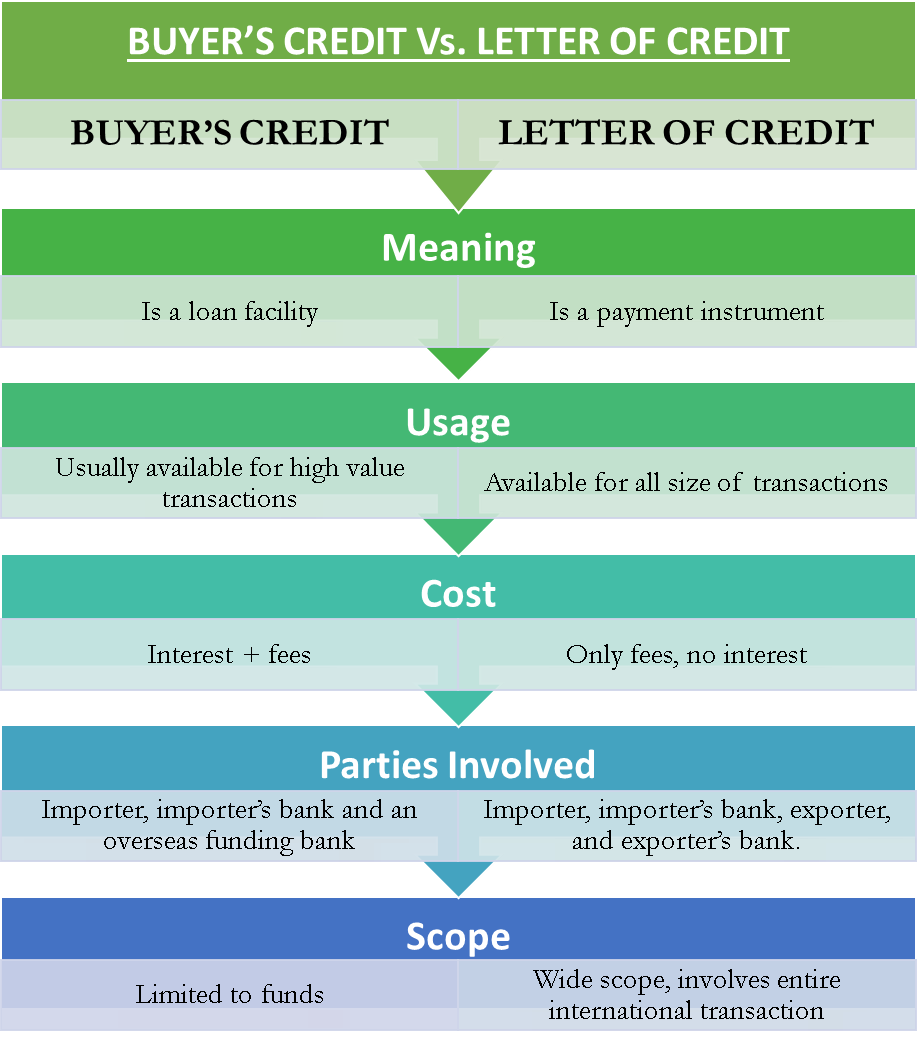

When one wants to expand the business means beyond the national boundary or within one needs assurance from the buyer side that after delivery of goods or services the payment will receive and this can be done by the bank only. Diff Between BG LC. Letter of Guarantee LG is somehow different because it applies between the buyer and the supplier even if they are in the same country as long as the other conditions mentioned for LC.

Both Bank Guarantee and Letter of Credit are used in trading finance. BG is more involved. LC ensures timely payment to the supplier upon fulfiining the conditionscriteria for the payment.

Both SBLCs or BGs can be issued and sent by Swift telex courier mail messenger or. There is a major legal difference between a bank guarantee and a standby letter of credit. In this sense a BG is more risky for the supplier as he has to wait till the bank clears his dues.

In this hindi video we understand the di. Letters of Credit LCs A letter of credit is a commitment taken on by a bank to make a payment to a beneficiary once certain criteria are met. Introduction Standby letter of credit is the guarantee provided by the issuer bank or financial institution that the responsibility of payment will be transfer upon the non-payment of party to the contract.

In short both these terms are used while doing business or transactions. But both are different financial instruments. The difference between the two instruments is the position of the bank relative to the buyer and seller of goods or services.

Major difference between a LC and a BG is that the issuing bank does not wait for a default from the buyer unlike BG where a formal request is made by the supplier to this effect. Difference between LC and SBLC top letters of credit providers Financial SBLC providers real SBLC Providers genuine SBLC providers lease sblc providers lease bg sblc providers bank instrument providers Financial SBLC Financial SBLC provider letters of credit for lease rent letter of credit rent Standby Letter of Credit lease standby letter of credit SLOC SBLC discounting. As per Letter of Credit once the obligation on production of documents on fulfillment of contract the bank pays amount to beneficiary.

The most important difference between letter of credit and bank guarantee is that iIn a letter of credit the primiary liability lies with the bank only which collects payment from the client afterwards. While the difference between a bank guarantee and letter of credit is readily apparent an LC is a rather simple straightforward document while a BG is used in big construction deals comparing SBLC vs. They are not monetizable if you want monetizable Bank Guarantees BG or Standby Letters of Credit SBLC please view the BGSBLCs menu on the front page of our web site.

A bank guarantee is a simple obligation subject to the civil law whereas a standby letter of credit is subject to banking protocols UCP 500 and ISP 98. And SBLC is a type of LC that is used when there is a contingent upon the performance of the buyer and this letter is available with the. Difference between LC and SBLC Published by BankersClub on June 12 2016 June 12 2016 Letter of Credit LC and the Standby Letter of Credit SBLC are used by Importers and Exporters in International Trade to ensure financial safety so that payment of the supplier is assured of payment once he has performed his obligation.

These DLC LC or SBLC are specific Bank Instruments to be used as payment guarantees for Importers and Exporters. Letter of Credit LC Standby Letter of Credit SBLC Important. In LC the payment is made to the beneficiary of LC only on fulfillment of the condition of LC whereas in BG the payment is made to the beneficiary of BG if the condition of BG are breached.

What is the difference between BG and LC. On 29 April 2014 The difference between LC and bank Guarantee can be stated in one sentence as under. The Letter of Credit and the StandBy Letter of Credit are two legal bank documents that are used by international tradersBoth these letters are used to ensure the financial safety between the supplier and their buyers.

In this type of instrument the issuing bank will have to follow all the banking protocols followed by the bank.

Difference Between Letter Of Credit And Bank Guarantee

Bank Guarantee Bg Vs Letter Of Credit Lc Hindi Youtube

Infographics Letter Of Credit Vs Bank Guarantee Mt700 Vs Mt760 Trade Finance Finance Lettering

Infographics Letter Of Credit Vs Bank Guarantee Acirc Euro Ldquo Mt700 Vs Mt760 Pdf Document

Standby Letter Of Credit Vs Bank Guarantee Differences Sblc Vs Bg

Difference Between Letter Of Credit Lc Buyer S Credit Bc

Difference Between Letter Of Credit And Bank Guarantee With Comparison Chart Key Differences

What Is The Difference Between Lc And Guarantee

Difference Between Bank Guarantee Bg Vs Letter Of Credit Lc Youtube

Sblc Lc Bg Financial Instrument Management Services Every Type Of Bank Id 22345807312

Icc 758 Bank Guarantee Sample Https Icckauppa Fi Files 2016 05 702 Icc Guide To Icc Uniform Rules For Demand Guarantees Urdg 758 Pdf

Different Types Of Cheque I Hope This Banking Knowledge Facebook

Bank Guarantee Know It Before You Make Mistakes Types Example Advantages Loanpersonal In

Difference Between Letter Of Credit And Bank Guarantee

Bank Guarantee What Is It Example Feature Types Limit Importance

Bg Lc In International Trade Grand City Investment Ltd

Bank Exams Miscellaneous Concepts Basel Norms Ombudsman Etc Offered By Unacademy

Post a Comment

Post a Comment